Investing in Gold: The 2024 Guide

Investing in gold is gaining momentum as its popularity has grown in recent years. Although investing in gold is a solid investment, just like investing in any other vehicle, it is important to study the strategy to avoid risk and maximize the chances of a successful return. This 2023 guide for investing in gold is a great resource to utilize as you explore this investment strategy.

Pictured, From left to right: Dove of Peace Gold bar, Lady Fortuna Gold bar.

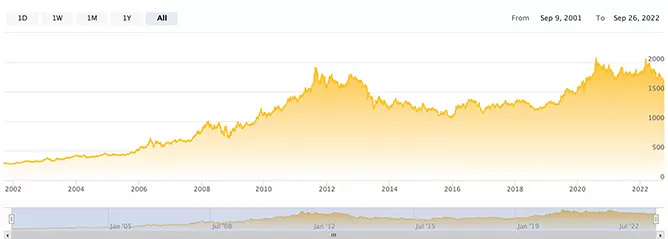

Check The Gold Price

The first and most critical need is to check the global price of gold to understand the current rates. Looking at historical trends allows you to anticipate future growth as it’s important to have a long-term perspective. Look at data surrounding gold prices in recent months and years, as this will help determine if the market is rising, falling or falterning. Although investing in gold is considered safer compared to investing in shares or other investment vehicles, it is still critically important to look at historical market data to understand past trends and anticipate future growth or decline.

Pictured: Gold price fluctuation graph.

Investing In Gold - There Is More Than One Way

There are a variety of different methods to invest in gold. Understanding your options allows you to select a strategy that works best for your needs.

1. Purchasing Gold Coins And Gold Bars

A common way to invest in gold is by purchasing bullion coins or gold bars. The wide variety of weights available, usually starting from 1 gram to 1 kilogram, also allows new investors to invest in smaller amounts and take a conservative approach as they learn how best to invest. This method is considered the safest strategy as it allows for a direct holding of gold without intermediaries, which is similar to how gold was purchased historically for thousands of years. This method may be considered less practical due to the difficulty of storing gold, however today there are simple storage and insurance options that facilitate the process. Investing in gold through The Israel Coins & Medals Corp. is one of the safest, simplest, and most efficient ways to purchase gold in Israel due to their credibility in the industry, their extensive knowledge, and their superior customer service.

2. Investing In Gold Through Companies That Deal In Gold

Another method to invest in gold is through buying shares in companies engaged in mining, buying, and selling gold. The value of these companies is very closely related to the global price of gold, so if you believe that the price of gold is going to rise, investing in companies that are going to profit from this rise is seen as a lucrative approach. This option is suitable for individuals who want to invest in gold indirectly through the capital market without holding physical gold through gold coins or gold bars.

3. The Purchase Of Basket Funds

The purchase of basket funds, also known as mutual funds, is a relatively common method. However through this strategy, the investor does not directly own the gold so it may be considered less reliable.

4. Buying Of Gold Futures

The purchase of futures contracts on the price of gold can be done through a dedicated gold exchange. Trading of these contracts takes place primarily on the New York and London stock exchanges. This strategy is not recommended for new investors in gold who are not experts in the field, however it is a vehicle to consider as you grow in your expertise.

Pictured: Investment-grade gold bars and coins.

What Affects The Price Of Gold?

Regardless of what investment strategy you pursue, before investing in gold it is important to understand the factors that impact the global price of gold. Gold has a tangible value, as it is less affected by inflation as it cannot be printed like common currency can. Gold cannot be removed from trading which can happen to securities of companies that have collapsed. The value of gold increases during periods of uncertainty and volatility. This happens through inflation when the stock market falls and the value of currencies erodes, or when a slowdown in the world markets is expected. During these periods, the price of gold remains relatively stable even when demand for it decreases. Because of this, it is often referred to as a safe-haven asset, which is a financial anchor that helps stabilize an investment portfolio.

Due to the value of having gold be a part of a diversified portfolio, the Israel Coins & Medals Corp. has been committed to making investment in gold accessible to the Israeli and global community for over 60 years.

Interested in learning more about investing in gold?

Interested in investing in gold? Explore ICMC Blog today.

Shop gold for investment now >>

Contact one of our representatives >>

The information contained in this website should not be construed as investment advice or as a substitute for investment advice suited to your own individual financial needs for purchase or investment, investment activities or transactions, or as recommendations or opinions as to the benefits of investing in gold or in any other specific products. The information contained in this website does not constitute an alternative for investment advice and you should not act upon it, before seeking advice adapted to your own personal situation and needs.