Record-Breaking Gold Prices: Q1 2024 seems to be only the beginning

An approx. 10% increase in gold prices in March, fueled by ever-increasing gold purchases by central banks, as well as geopolitical tensions without an end in sight, broke the metal’s prices records. What caused this, in which markets the demands were record-breaking – and why do most analysts estimate that the trend will continue?

The gold price broke the $2,100 per ounce barrier only last December, but a 10% increase in March led to another record - almost $2,250. At the time of writing, gold is above $2,350. The World Gold Council’s data published last month, reviewing 2023 demands, points to central banks remaining as a major motivating force for demands, as well as private investors fearful about the state of the traditional economy.

Geopolitical Tensions and Economic Instability

Periods of economic uncertainty and geopolitical tensions tend to support an increase in gold prices. Investors tend to seek safe haven in times of uncertainty, and the historical stability of gold makes it a particularly attractive option.

Most analysts estimate that a reelection of Donald Trump as the US President will increase demand for the metal, as it will add to the uncertainty regarding ongoing wars in Ukraine and Israel. The growing possibility of Trump’s reelection already affects gold prices, and the tense US elections will add fuel to the fire in this already stormy political climate.

Depicted above: Holy Land Mint Gold Bars

The increasing demand for gold is reinforced in the jewelry market as well, which enjoys a rising demand for gold and tends to combine gold purchases for decorative jewels with investment. Facing an uncertain economic state in their country, Chinese consumers bought approx. 603 tons of gold jewelry in the past year, an increase of 10% compared to 2022. And while demand for gold jewelry in India slightly declined, the investment of private consumers in gold bars and coins significantly increased.

Central Banks as A Major Motivating Force for Demands

Central banks continue to lead the demand for gold. Despite the increase in interest rates in 2023 and the strong USD, which usually weaken the attraction to gold, central banks continue to accumulate gold in record-breaking amounts.

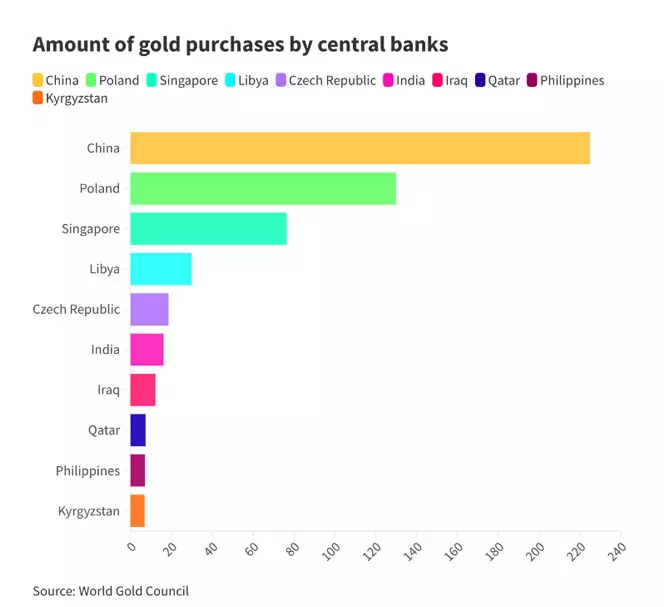

China is the primary player in gold consumption by private consumers and entities and in purchases by its central bank, with the prediction being that gold will remain in high demand due to the current economic struggles and the troubled local real-estate market. Other countries also diversify their reserves into gold; Poland, Singapore, and Turkey – all bear evidence for the significant rise in gold purchases in 2023.

Depicted above: the scope of gold purchases by central banks in 2023, in tons.

Depicted above: the volume of gold purchases by central banks in 2023, in tons.

Two Continuous Years of Peak Demand for Gold

The global demand for gold peaked at 4,899 tons in 2023, motivated by strong purchases by private consumers and a high purchase rate by central banks.

In 2023, the world’s central banks purchased 1,037 tons of gold. This amount is almost the highest in history, second only to 2022 when 1,082 tons of gold were purchased, a record-high scope of gold purchases by central banks. Per the World Gold Council’s reports, it appears that Q1 2024 also showed similar scopes.

“In addition to monetary policy, geopolitical instability is often a major motivating force for the demand for gold, and in

2024 we expect a pronounced effect on the market”, said senior market analyst Louise Street in an interview for the Economic Times, over 60 election campaigns around the world, prolonged conflicts, and economic instability are expected to attract investors to gold, desiring a safe haven, said Street.

On the background of unending geopolitical tensions, the continued gold purchases by central banks, and private investors increasingly choosing the “safe haven asset”, most analysts predict that the leap in gold prices seen in Q1 2024 is only the first sign pointing to a new record-breaking peak.

Interested in learning more about investing in gold?

Interested in investing in gold? Explore ICMC Blog today.

Shop gold for investment now >>

Contact one of our representatives >>

The information contained in this website should not be construed as investment advice or as a substitute for investment advice suited to your own individual financial needs for purchase or investment, investment activities or transactions, or as recommendations or opinions as to the benefits of investing in gold or in any other specific products. The information contained in this website does not constitute an alternative for investment advice and you should not act upon it, before seeking advice adapted to your own personal situation and needs.