How Much Should You Invest In Gold And Silver?

Purchasing gold and silver is an investment that is suitable for a wide range of purposes and for all types of investors, starting from amounts of only hundreds of dollars. In this article, we will review the variety of considerations that you should consider when deciding how much to invest in precious metals.

As we have seen in the previous blog article, investing in gold and silver adds valuable diversity to your investment portfolio. Once we have decided that we want to purchase precious metals, one of the first questions we will be faced with will be what amount to allocate for this purpose.

It should first be clarified that there are many factors that influence thedecision on how much to invest in gold and silver, as in assets and other investment channels, there is no single formula that will answer this question. Knowing about this fact, we will review in this article the main considerations that are worth considering when we decide what amount will be allocated for the investment in the world of precious metals market.

Budget

Of course the budget available for investment is a crucial consideration in deciding how much to invest in gold and silver. However, it is important to remember that investing in precious metals is not just a business for the rich. Assets made of gold and silver are manufactured in a wide range of sizes, from 1 gram to 1 kg, so precious metals can be added to the investment portfolio even in amounts of only hundreds of dollars. Every investor can find the right investment product for him, depending on the budget available.

Holy Land Mint Gold Bars weighing 1 gram to 1 kg.

Investment time frame

Investing in gold and silver enjoys high marketability everywhere, and can be purchased and sold at a known and acceptable price set in the international markets. As we are guaranteed, at a high degree of certainty, in our ability to trade in these assets, this is a very suitable investment for any time frame, short or long.

However, gold and silver give special value to long-term investments. These treasures are particularly durable, both on the physical level and on the economic level. It is therefore a recommended investment when we want to keep our personal capital for very long periods, and even pass it on to future generations.

Investment objectives

As we have reviewed in previous articles on gold and silver. Investing in precious metals has many unique characteristics. Because of this, it is a financial move that may hit the goals of many investors, whether they are conservative and cautious or enjoy risk taking. It is especially worth noting that gold and silver have always been characterized by being sought-after assets, with low dependence on other assets (such as stocks or real estate) and also enjoying a particularly high aesthetic value.

Experienced investors tend to define the allocation of their assets, and make sure to balance the portfolio accordingly when the prices of a particular asset go up or down. This is how it is recommended to do with investing in gold or silver, just as it is desirable to do with our investments in stocks, bonds or real estate.

Even under the most conservative approaches, it is advisable to allocate to precious metals at least 5% to 10% of the investment portfolio. Alongside this advice, a well-known rule of thumb states that the gold and silver holdings of novice investors should be up to 15% of the portfolio, depending on the factors mentioned above.

"A quarter of the portfolio - in gold"

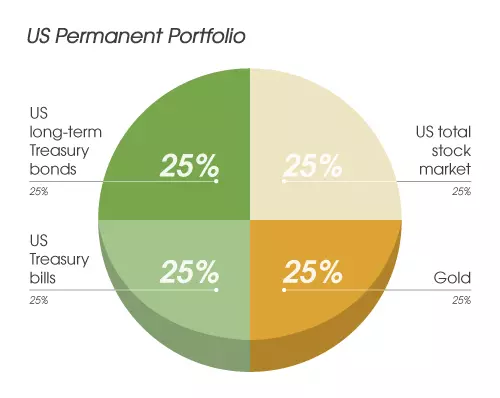

There are well-known and popular investment theories that explain why holdings in precious metals should reach up to a quarter of the portfolio. Prominent among the experts who discussed this was Harry Browne, a world-renowned American investment guru. Browne created the theory of the "permanent portfolio" - one that will prove itself against all possible fluctuations in the market, in times of crisis or prosperity.

Browne argued that a well-diversified investment portfolio, which is expected to maintain relative stability and yield optimal returns, should be divided into four quarters: stocks, bonds, cash - and gold. The gold investment channel is designed to stabilize the portfolio and yield returns, especially in times of raging inflation and economic instability.

Harry Browne's Permanent Portfolio. "25% of the portfolio - gold".

Brown explained that the great advantage of gold is in being independent of any whim and political or economic manipulation. "When paper-based systems start to crack - the gold rush could explode," Browne said. For these reasons, he recommended that precious metals should be held as physical gold, bars or bullion coins. In this context, the printing of trillions by the central banks following the corona crisis, should be remembered, which did support a sharp rise in the price of gold.

In conclusion, it can be seen that there are a variety of approaches to the right amount to invest in precious metals - the most conservative recommend 5% to 10% of the investment portfolio, alongside the popular Harry Browne model that offers to allocate about 25% of the portfolio to gold. Considerations may vary between each investor depending on the investment time frame objectives, investment range and budget available to the investor.

Shop gold for investment now >>

Shop silver for investment now >>

Contact one of our representatives >>

The information contained in this website should not be construed as investment advice or as a substitute for investment advice suited to your own individual financial needs for purchase or investment, investment activities or transactions, or as recommendations or opinions as to the benefits of investing in gold or in any other specific products. The information contained in this website does not constitute an alternative for investment advice and you should not act upon it, before seeking advice adapted to your own personal situation and needs.