How To Invest In Gold And Silver?

Gold and silver are reputable assets known to be reliable, safe and stable. If you too want to join the millions of investors in precious metals in the world, the guide in front of you will accompany you in the first steps in this field.

Precious metals, at the top of them, gold and silver, have proven themselves for thousands of years as a financial instrument for a "rainy day" that provides stability to the investment portfolio during periods of market turmoil. This can also be clearly seen in the corona crisis, with a jump of tens of percent in the prices of precious metals.

In this article, you will find a guide in three simple steps that will accompany you in the first steps in the unique market of precious metals.

1. Choose an investment alternative

There are a wide variety of investment tools that will expose you to the precious metals market, such as ETF’s, mutual funds or buying shares of mining companies. But the investment that is considered the safest is the purchase of the "real thing" - the best way to invest in gold is by holding a physical asset made of gold or silver. The reason for this is clear: holding a tangible asset in self-ownership gives the investor full control, compared to owning a security that depends on the promises of other parties.

Therefore, experienced investors in the precious metals market choose to allocate part of their personal capital to the purchase of assets made of gold and silver, thus creating for themselves an investment route free from any dependence on banks, stock exchanges or investment managers. In the current era, where governments and central banks are pouring trillions of dollars into markets, inflating countries' debts and increasing fears of inflating bubbles in the capital and real estate markets, the advantage of investing in physical metal is sharpening. This is an excellent hedging alternative, which ensures direct ownership of a liquid financial asset, free of risk.

2. Before You Invest in Gold - Determine the amount of investment

Another consideration that accompanies the investment in precious metals is of course the budget available to us, which will affect the products we choose to purchase. It is important to emphasize that investing in gold or other metals is suitable for any investor, small or large. Purchasing gold and silver properties is also possible with a budget of only hundreds of dollars. The great advantage of the precious metals is that their production is done in different weights - from 1 gram to 1 kg. Each investor can find the right investment product for him depending on the budget available to him.

Investing in gold or physical silver is usually a long-term investment that we want to keep for realization at the right time. Therefore for the novice investor we recommend that the total investment in precious metals does not exceed 15% of the volume of his investment portfolio (although according to some approaches up to a quarter of the portfolio for precious metals should be devoted). Depending on the budget we can plan the specific properties we would like to purchase.

The Holy Land Mint gold bars, weighing 1 gram to 1 kg.

3. Choose the right property for investment

Once we have defined the budget, we will move on to choosing the right investment products for us, depending on the type of metal, weight and price.

Invest in Gold or silver? - we prefer both

In general, we would prefer to diversify the investment portfolio in precious metals and hold, if possible, both gold and silver. This is due to the unique benefits that each of them adds to our portfolio. You can read in detail about the properties and benefits of gold and silver in articles devoted to it in the blog - a series of articles on the history of gold and two articles about the metal of silver.

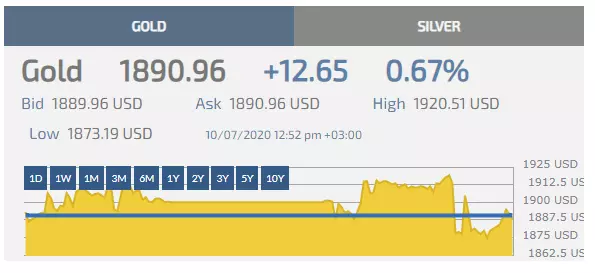

How are precious metal prices determined?

Metal prices change at any given moment depending on their base price in the market known as "Spot". The "spot" price of any precious metal is affected by the waves of demand and supply in the markets and consists of two factors: the average price that sellers ask (Ask) and the price that buyers want to pay, which is slightly lower (Bid). In addition, a fixed addition, a premium, is accepted above the "spot" price - for production, transportation and insurance. The usual unit of weight according to which the prices in the world of precious metals are stated is the troy ounce, which is equal to 31.1 grams.

On the company's website, you can follow the "spot" prices of gold and silver, which are constantly changing. It is important to know that in accordance with the change in the "spot" price, the prices of the investment products on the site are updated, as is customary on the trading sites in the world. The page for each product also indicates the premium for it (on the Hebrew website, the premium includes 17% VAT as required by law).

Choosing the right investment property for me

There is a wide range of investment products made of gold and silver, and we can choose between ingots, rounds (round ingots) or bullion coins (coins intended for investment). Quality sources of production will be the world's leading mints, and in Israel the Israel Coin and Medal Corp. (ICMC), which has a reputation of decades behind it. Unlike collectors, investors often focus on the precious metal itself and the design or logo embossed on the products is of secondary importance to them.

In the investment category on the corporation’s website, you can choose investment products made of gold and silver produced by ICMC under the trademark - The Holy Land Mint. The wide product line, from 1 gram to 1 kg, allows every beginner investor to learn and experience investing easily, even in small amounts. Along with the corporate’s products, you will also find a selection of investment products from the world's leading mints.

From right to left - Dove of Peace Gold Bullion, American Eagle and Australian Kangaroo Gold Bullion Coins.

Shop gold for investment now >>

Shop silver for investment now >>

Contact one of our representatives >>

The information contained in this website should not be construed as investment advice or as a substitute for investment advice suited to your own individual financial needs for purchase or investment, investment activities or transactions, or as recommendations or opinions as to the benefits of investing in gold or in any other specific products. The information contained in this website does not constitute an alternative for investment advice and you should not act upon it, before seeking advice adapted to your own personal situation and needs.