Get To Know The Different Types Of Precious Metals

Gleaming gold, useful silver, rare platinum and palladium – these are the precious metals that are multi-valued assets for investors, collectors, dealers and industrialists. Some of them have been recognized as such for thousands of years, while others, only in more recent times.

They all have common natural properties, which have contributed to the recognition of their unique quality. In this article, we will explain how and why gold, silver, platinum and palladium have become precious metals and what their natural properties and uses are.

The hard core of the precious metals, the main feature that characterizes each of them, is the fact that they are noble metals. These are the metals that are characterized by their very high resistance in different conditions, over time. Man has recognized this unique quality and made use of it by creating assets for investment and production of a range of products.

There is a simple reason behind the fact that precious metal is always a noble metal: an asset that is used as a means to accumulate value or for payment has to be resistant and sufficiently stable, for as long a term as possible. Only in this way can a person receiving coins composed of a noble metal be assured that they will maintain their value for future use and even become an heirloom for future generations.

Rare Metal

Another outstanding property of the precious metals is their rarity. Rarity has an effect on demand and supply, and therefore also on the price. When supply of a certain asset is limited, its price will remain stable and even increase in situations when demand rises.

Types of Precious Metals and the Uniqueness of Each

GOLD

- For thousands of years, humanity has accorded gold a unique status by virtue of its glowing appearance, rarity and the exceptional resistance of this metal. Gold coins provide a means of maintaining value and transfer of wealth, which has proven itself in countless economic and political crises.

- In the period known as the Golden Age that went on until the mid 20th century, gold was the global currency, to which all other means of payments were linked. Until now, there are some who call for a return to the gold standard as a protection against inflation and limitless printing of money, which has brought down the value of national currencies such as the Dollar and Euro.

- As of the present, about 190 thousand tons of gold have been mined in the world and about another 50 thousand tons are still hidden underground. Besides being an investment in the form of bars, bullion and coins, gold is also a popular raw material, especially in the jewelry industry.

- Much more information about the golden metal can be found in our series of articles on the history of gold

SILVER

- This metal with its prestigious, bright appearance has enjoyed a unique status for thousands of years, even though it is less rare than gold. The main reason for this is that it is a raw material of great use. In addition to the jewelry industry in which it has always been considered a popular metal, silver has been put to use in many other industries, from electronics to solar panels.

- Production of silver takes place mainly in South America and some other large mines in China, Russia and Poland. The total supply of silver above-ground is estimated at 1.75 million tons.

- Silver is a popular metal with investors, as it contains two components in one: the natural advantages of a noble metal together with the many uses to which it can be put in several different industries.

- Much more information about silver can be found in our articles on "Get to Know Silver".

Pictured: The Holy Land Mint Dove Round

PLATINUM

- In contrast to gold and silver, platinum is a metal less known as an investment asset, but one that rates higher than them in its natural qualities. Platinum is more resistant to breakage or development of corrosion than gold and is also 20 or 30 times rarer than gold.

- Supply of this silvery-whitish metal which has been used by man for thousands of years, comes from mines in South Africa.

- Platinum serves in jewelry production and industry. Its most popular use, however, is in production of catalytic converters for control of diesel and gas emissions from engines, particularly in the automobile industry. Some estimate that demand for platinum will increase in the coming years as awareness grows for the quality of the environment.

- The price for platinum reached its climax at the end of the previous decade and since then has gone down by about 50%, such that today it is relatively inexpensive. In recent years, it has traded at a price level of about $1,000 an ounce.

PALLADIUM

- Palladium, which belongs to the platinum family, is the "youngest" precious metal, discovered only at the beginning of the 19th This metal which is even brighter and softer than platinum is mixed with gold in jewelry production to create an alloy known as "white gold".

- The quantity of palladium mined annually is less than a tenth of that of gold. The greatest mine production of palladium is in Russia, where supply is often regulated in order to maintain or increase its price. Greatest reserves of this rare metal are found in South Africa.

- Like platinum, the most common use of palladium is in the automobile industry, where it is used in production of catalytic converters for reducing polluting emissions. Other uses are in jewelry production and health industries.

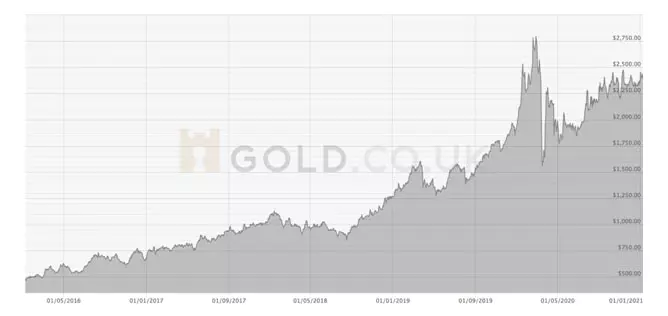

- Demand for palladium soared in recent years, particularly for car production, due to the environmental quality requirements. In the past decade, palladium became one of the world's good investments, rising by about 500% in price. Since supply of palladium is not expected to increase in the near future, it is estimated that its price will continue to rise sharply over the next few years.

In the graph: Change in value per ounce of palladium in dollars from 2016-2021. Origin: www.gold.co.uk

Shop gold for investment now >>

Shop silver for investment now >>

Contact one of our representatives >>

The information contained in this website should not be construed as investment advice or as a substitute for investment advice suited to your own individual financial needs for purchase or investment, investment activities or transactions, or as recommendations or opinions as to the benefits of investing in gold or in any other specific products. The information contained in this website does not constitute an alternative for investment advice and you should not act upon it, before seeking advice adapted to your own personal situation and needs.