Get To Know Silver, Part 1: Precious Metal For Investment, Jewelry And Industry

Since ancient Egypt, silver metal has been a luxury raw material for making coins and jewelry. Its unique natural properties have also made it extremely useful for a wide range of industries, from electronics to solar panels. In the past, silver coins were a major means of payment in many countries, and today they are an attractive and unusual investment asset.

Throughout history, mankind has tried many types of commodities as a means of exchange - such as barley, shells and even heavy stones, which were a means of payment in the islands of Micronesia. Only a small proportion of these commodities have proven to have suitable investment and barter properties - thanks to their mobility, durability and suitable supply.

One of those unique commodities is silver metal. For thousands of years, silver has been used as an investment asset, a trading device, an accessory for decoration and a raw material for industry. Silver is a useful raw material for electrical and electronic products, smartphones, solar panels and medical accessories. The photography industry is a particularly large consumer of silver, though less so than in the past, due to the shift from film to digital photography. Overall, the amount of silver required for industrial needs increases over the years.

The reasons that led to the unique status of silver metal are closely related to its natural properties. Pure silver is a perfect reflection of light and therefore its color is whiter than any other metal, a feature that gives it the bright and luxurious look that is associated with it. At the same time, silver conducts heat most efficiently of all metals - and is therefore particularly suitable for jewelry making.

Silver jewelry. Courtesy of G.R.A.S Inc.

How much silver is there in the world?

The largest and most active silver mines in the world are in South America. More than a quarter of global output comes from Mexico and Peru. Other prominent silver producers are China, Russia and Poland. The total supply of silver above ground is estimated at 1.75 million tons, according to the Geological Survey of the United States.

Of all silver supply in the world, most of which is used for industry and jewelry, only about 80,000 tons of silver are held in the form of bars and coins in which most of the trade is done for investment purposes. Some of the silver stock has probably been lost over the generations, including as industrial waste, a high rate relative to gold that has been more carefully preserved.

From right to left: VALCAMBI Silver Bar, Dove of Peace Silver Round, Holy Land Mint 1 kg Silver Bar.

Although the supply of the whitish metal is wider than the supply of the yellowish metal, so the price of silver is always lower than the price of gold - but as we will talk about later in this article, the relatively cheap price also has advantages from the point of view of investors.

Silver coins: from our ancestor Abraham to the dollar

Many historical sources include reference to the use of money for various purposes, which began with the dawn of humanity. The Bible abounds in references to the silver metal, which was measured in shekel units - equivalent to about 11 grams of barley.

In the biblical story of the purchase of the Cave of Machpelah, Cave of the Patriarchs, it is written, "And Abraham obeyed Ephron, and Abraham weighed to Ephron the money which he had spoken in the ears of the Hittites." Hebrew adopted the word silver to describe both metal and the most common means of payment, so it is the equivalent of two English words: Silver and Money.

Ancient Egypt is the earliest culture from which there is evidence of widespread use of gold and silver for worship, decoration and trade purposes. The Egyptians were also the first to identify economic value in determining an agreed-upon relationship between them. This allowed traders and investors to value their capital and conduct more efficient barter trading.

Following the Egyptians, other cultures simultaneously used gold and silver coins while establishing an agreed-upon ratio between them, such as the Romans. The ratio of silver to gold ranged in the early period from 2 to 1 to 10 to 1 and in the Middle Ages it climbed to 16 to 1 - as the understanding sharpened that gold is much rarer than silver. In the second part of the article we will learn more about the importance of the relationship between gold and silver prices, which are currently traded in a way that does not depend only on their physical supply, and how this value can be used to assess the viability of investing in silver.

In recent centuries, many countries have adopted national currencies made of gold and silver as the official means of payment. As a result, the conflict over the preferred metal intensified: supporters of the gold standard wanted to make it the dominant currency, while supporters of the silver standard saw it as a superior instrument as a means of barter. Support for the silver standard was particularly strong in South America, which enjoyed an abundant supply of the whitish metal, and in the Imperial China where silver was used as the main raw material for coin production.

Gradually, most countries adopted the gold standard, but in the United States there was a fierce struggle over the 19th century. Even after the United States adopted the gold standard, the daily use of silver dollar coins continued for decades - until they became a collector's item and an investment asset.

Right to left: Dollar coins made of silver, American Eagle Bullion coin.

The Big Silver Investors: The Speculators

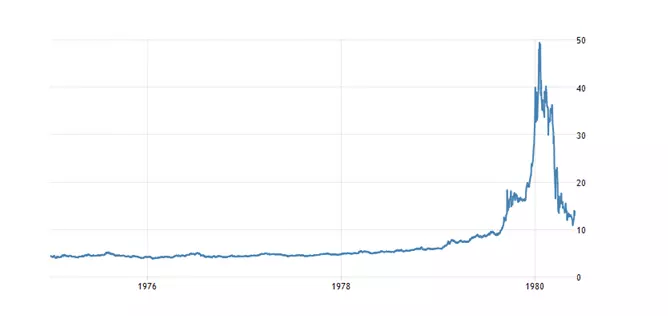

In recent decades, along with the demand for silver for industrial purposes, trade in it for investment purposes has developed greatly. One of the most dramatic events in the field occurred in the 1970s in the United States. Responsible for the biggest upheaval ever in the silver market were the brothers William and Nelson Hunt, who inherited their fortune from their father, owner of a thriving oil field in Texas and one of the richest people in the world at the time.

The Hunt brothers were troubled by the surge in inflation, which quickly eroded the value of the dollar and hurt the value of their assets. They were looking for a market that was not dependent on the dollar and that they had the opportunity to influence, in their opinion - and chose to storm the silver market. The brothers purchased huge amounts of contracts to buy silver, bars and coins - and hid them in Switzerland, out of reach of the US administration.

The energetic activity of the Hunt brothers increased the price of silver sharply and within a few years it climbed from about $ 5 to about $ 50. Their success caught the attention of more investors who rushed to follow suit and further increased demand. Despite this, the Hunt brothers controlled most of the tradable silver in those years.

The jump is in value of an ounce of silver, in dollars, following the activities of the Hunt brothers.

But the result was very different from what the Hunt brothers had hoped for. The overload of demand caused a shock that the market had difficulty withstanding, and there was a fear of the collapse of the stock exchanges for trading in silver that made it difficult to raise a sufficient supply of bars and coins. The result was aggressive intervention by the United States government, which mobilized to protect the stock markets. The U.S. government accused the Hunt brothers of illegally taking over the market and banned further purchases of silver. The Hunt brothers, who tried to protect their fortunes for fear of government inflation and financial manipulations, eventually led to a brutal intervention in a market unparalleled since the gold rush during the Great Depression of the 1930’s.

Big Silver Investors: Warren Buffett

Not only unstoppable speculators like the Hunt brothers were interested in the silver metal. A more solid investor who recognized the unique qualities of the luxury goods is who is considered the best investor in the world: Warren Buffett. Through his investment firm, Berkshire Hathaway, Buffett bought thousands of tons of silver in the late 1990’s - a huge acquisition that caused a temporary shortage and yielded the company a profit of about $ 100 million.

Warren Buffett. Purchased thousands of tons of silver during the 1990’s.

Buffett continued to hold on to silver metal for about a decade, with prices climbing from about $ 5 to about $ 13 an ounce. In fact, Buffett missed out on the impressive climb that money recorded in subsequent years, to a record high of about $ 50 an ounce following the 2008 financial crisis.

Buffett's investment in silver metal is particularly interesting, as he traditionally opposes investing in gold. Buffett justified the choice of silver by saying that it is a raw material that is also used for industries, so he saw it as a commodity with a more significant value compared to gold, whose practical use is more limited. But as mentioned Buffett also greatly enjoys the value of silver metal as an investment asset. In the second part of this article, we will delve deeper into various aspects related to this.

Shop silver for investment now >>

Contact one of our representatives >>

The information contained in this website should not be construed as investment advice or as a substitute for investment advice suited to your own individual financial needs for purchase or investment, investment activities or transactions, or as recommendations or opinions as to the benefits of investing in gold or in any other specific products. The information contained in this website does not constitute an alternative for investment advice and you should not act upon it, before seeking advice adapted to your own personal situation and needs.