History Of Gold, Part 2: Abundance And Prosperity In The Global Gold Age

For thousands of years, humanity has learned that the most reliable and secure means of payment, independent of governments and not exposed to economic crises, is gold. As a result, in the 19th century, glittering metal became the most powerful and common global currency, and humanity gained one of the most unique periods of abundance and prosperity in history. In this next article, we will describe how and why the world enthusiastically adopted the gold standard and why it did not last despite the tremendous value it produced.

In the first part of the article on the history of gold we described how world trade developed using a wide variety of coins made from many types of metals including gold, silver and copper. This payment method has proven to be effective and successful - but its great success has also created significant challenges. In each country different means of payment were introduced which were sometimes replaced due to wars, conquests or economic crises. The laws regarding valid means of payment have also changed according to changing needs and interests. Sometimes money is ruled by capitalists and most often by the king or other political ruler. The world was in a monetary turmoil.

The challenges created by having to work with countless different means of payment are familiar to us even today, albeit in a slightly different version. These are questions such as: How will a trader deal with the need to convert between different types of currencies? At what rate will the conversion take place? And how do long-distance carriers carry a variety of means of payment, each suitable for a different region or country and some of which may be relatively heavy, such as gold bars? And equally important, how will the states settle the debts or surpluses accumulated in trade between them?

From right to left: Dove of Peace bullion, American Eagle bullion coin, Australian Kangaroo bullion coin.

Gradually, merchants and governments realized the benefits of setting a global payment standard. The understanding was that the broader the consensus on the method of payment, the more conveniently and efficiently the conversion matters would be arranged, free and prosperous global trade would be ensured. These insights led to one of the most unique periods in human history, which lasted from the 19th century to the beginning of the 20th century

The monetary revolution took place in two parallel tracks:

At the local level - Kings and governments who wanted to establish their rule introduced laws that stipulated that inside their territory will be used only coins issued by the local regime. Gradually, all countries issued national currencies that replaced other means of payment, such as regional money or commercial banknotes.

At the global level - There is widespread agreement among governments, businessmen and citizens that the anchor for a payment system must be particularly stable. That is, to ensure full confidence that government money is indeed worth the paper on which it is printed or the currency on which the ruler's image is stamped - it must be anchored in an asset whose value does not collapse due to political or economic crises.

As we previously saw in the first part of the article, two metals gained the greatest reputation and competed head to head for the status of the world's most powerful payment asset, gold and silver. But the one who proved to be the most valuable thanks to his exceptional durability and rarity - was the gold.

"Gold is money, everything else - credit"

For thousands of years, gold has evolved as the global currency - the reference point whereby entities and individuals measure their money. Gold has become increasingly accepted as a scale for comparing the value of different products or for conducting international trade. Then, almost at once, most countries in the world adopted the gold standard. The central role played by gold at the time can be described as the 19th century version of the US dollar today, although there are significant differences that we will discuss in the next lines.

What was the uniqueness of the gold standard? Today, the value of the dollar stems from the reputation of the United States as the most powerful economic, political, and military power in the world. That is, we estimate that the United States is a strong and rich country and also anticipate that it will remain so in the future. That's the reason why almost everyone in the world will be happy to receive the dollars it prints because it trusts that they will retain their value. In contrast, the gold standard was not only based on the power of a particular country, however strong it may be, but on an asset that is not dependent on any country - the gold. Each country has pledged to ensure that the national money it issues is actually physically backed by bars and bullion made of gold.

The countries have adopted a full gold standard, according to which the state holds a stock of gold which is equal in value to the full value of the banknotes and coins in current use; Or a partial gold standard in which states have pledged to hold gold at a value equal to a certain ratio of the stock of money held by citizens. In practice, as a result of economic dynamics and financial constraints, the gold inventory was mostly partial and varied between periods of abundance and crises. At that time, all international trade and the balance of payments between the countries were based on the shiny metal and imports and exports of gold were completely free.

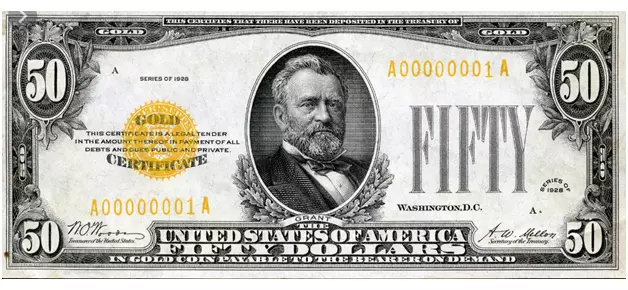

The great value of the gold standard was due to the fact that the system was based on full trust and transparency. Anyone who used dollars, pounds sterling or marks received from the governments of the United States, Britain or Germany an explicit promise that at any time he was guaranteed the right to convert the banknotes and coins in his possession into gold. Thus, in those years dollar bills bore the explicit inscription that the dollars represent gold coins which "will be paid to the bearer of the bill on demand." During a debate on gold in the 1912 U.S. Congress, banker and billionaire JPMorgan coined the well-known saying: gold is money, everything else is credit.

A US dollar bearing the inscription that the banknote represents physical gold.

The gold standard also ensured protection against the danger of inflation and price rampage that make money worthless. When a country has the option to print money at will, as is customary in the world today, the value of money is eroded. In contrast, the gold standard restricted the printing of banknotes and the minting of coins according to the stock of ingots and bullion that each country holds in its cellars. Therefore governments also had to limit their spending on salaries, infrastructure or the military.

As might be expected, countries found it very difficult to meet the challenge of limiting spending. Later in the article we will describe their search for ways to evade the limit on money printing, resulting in the disintegration of the gold standard, despite its obvious advantages.

The Gold Rush

Apparently, the first country to adopt a full gold standard was the United Kingdom. During the 19th century, the British Empire controlled a fifth of the earth's surface, between Australia, India and Canada, so the British move changed the rules of the game worldwide. Britain adopted the gold standard after an economic crisis that led to a flood of coins made of silver that had lost their value and out of a desire to introduce a more stable monetary system. In 1854, Portugal also joined the gold standard, as part of an unsuccessful attempt to revitalize its empire.

But the moment of the beginning of the world golden age is usually marked in 1871. Germany, newly united into an empire under the political leadership of Otto von Bismarck, has become one of the most powerful countries in Europe. After unification, Germany adopted the gold standard and swept after it the countries that had not yet decided on the matter.

France, Switzerland, the Netherlands and Spain followed Germany first. Russia and Japan did so a little later, in 1897. After severe political controversy, the United States also completed its accession to the International Gold Standard in 1900. A document establishing the gold standard in the United States solemnly stated that the goal is to "set a standard of value, protect equality between all forms of money issued or minted by the United States, and refinance public debt." United States banknotes will be converted into gold convertibles at a historical value of $ 20.67 an ounce. While the law allowed the use of silver coins and called for an international agreement for the use of both types of metals, the current regulation enshrines the upper status of gold in the United States monetary system. "

From right to left: Lady Fortuna Gold bar, Dove of Peace Gold bar.

With the growing success of the yellow metal, it was discovered that America was a real gold mine - and the phenomenon engraved in history and culture called the "gold rush" arose. The gold rush peaked in the mid-19th century, when hundreds of thousands flocked to California from across the United States and around the world following stories of the abundance of gold inherent in rivers, mountains and mines - and the dream of rapid enrichment. At that time, the use of carats as a unit of measure for the level of purity of objects made of gold also began.

Golden-sponsored peace

The Golden Age was a time of relative global stability and tremendous prosperity for industry and commerce on a scale never seen before. Unfortunately, the quiet began to unravel with the outbreak of World War I. The Great War aroused an urgent need for cash to finance the battles and equipment. This became the main reason why countries were tempted to disengage from the gold standard and sought to print banknotes at an increasing rate in order to maintain their armies.

The gold standard will continue to play an important role in the economic history of the 20th century, which we will discuss in the third and final part of this series of articles about the history of gold. With the outbreak of World War I, however, the governments regained the freedom to print money at their discretion, thereby eroding the value of the money held by the citizens - the same phenomenon that the gold standard had hitherto protected. On this ground grew severe inflation and the economic crises of the 1930s, which eventually led to the outbreak of World War II. The undermining of the gold standard marked the world's transition to one of the deadliest and darkest periods in history.

Shop gold for investment now >>

Contact one of our representatives >>

The information contained in this website should not be construed as investment advice or as a substitute for investment advice suited to your own individual financial needs for purchase or investment, investment activities or transactions, or as recommendations or opinions as to the benefits of investing in gold or in any other specific products. The information contained in this website does not constitute an alternative for investment advice and you should not act upon it, before seeking advice adapted to your own personal situation and needs.